Austerity and Hard Brexit:

The anti-growth coalition

Geoffrey M. Hodgson

“Hard Brexit is austerity on steroids.”

Warning: this blog criticizes all three major UK political parties.

“Hard Brexit is austerity on steroids.”

Warning: this blog criticizes all three major UK political parties.

Here we go again. More austerity. Britain now faces big cuts in the public sector, slashing real levels of spending on the NHS, education, pensions and defence. This is said to be essential to bring down public spending in line with tax revenues, and to calm the markets.

The disastrous Kwasi Kwarteng budget of 23 September 2022, put the UK public deficit on course to reach an annual £70 billion. Jeremy Hunt’s subsequent reversal of the reckless tax cuts in the Kwarteng budget may have halved that expected figure. The latest Chancellor is determined to bring down public expenditure still further, to less than income from taxation, so that more of the accumulated national debt can be paid off. All this, while Britain moves into a serious recession.

To those accustomed to think of a national economy as if it were a household, these measures may sound sensible, albeit painful. Like an individual or a family, we must “live within our financial means”.

But there is a big difference between a household and a nation that has the capacity to issue its own sovereign currency. This is crucial for Keynesian arguments against austerity. In his General Theory of Employment, Interest and Money

(1936) the great economist – and Liberal Party member – John Maynard Keynes argued that public spending in excess of revenues could be useful for bringing an economy out of stagnation or recession. The resulting growth would then increase tax revenues, and budget deficits might come down as a result. Annual public expenditure does not always have to be matched or exceeded by annual public income.

Keynes did not deny that inflation could be a major problem. Instead he advocated policies to reduce and restrain inflation, without creating a recession or increasing unemployment.

Keynes ideas on fiscal stimulation were part of the political consensus in most developed countries from the 1940s to the 1970s. Hence the term “Butskellism” in the UK, where two successive 1950s Chancellors of the Exchequer, Labour's Hugh Gaitskell and the Conservative R. A. Butler, both favoured Keynesian demand management to reach full employment and maintain a strong welfare state. Similar views were prevalent among mainstream economists at the time. They are found in many of the leading economics textbooks of the 1950s and 1960s.

The anti-Keynesian revolt

A minority of economists in Chicago and elsewhere opposed these Keynesian arguments. They included Milton Friedman and Friedrich Hayek. Global economic instability in the 1970s fractured the Keynesian consensus. Chicago ideas gathered a wider following among economists and politicians.

The re-emerging Ideas of a balanced national budgets, with low public expenditure and a minimal state, have a much longer history, going back to Herbert Spencer and many others in the nineteenth century and before. They were supported by Enoch Powell and his followers in the Tory Party in the 1950s and 1960s. Keith Joseph persuaded Margaret Thatcher to support Friedman’s ideas. Thatcher became leader of the Conservative Party in 1975.

The Labour Party was affected too. While always rejecting the idea of the minimal state, the Labour Prime Minister James Callaghan abandoned Keynesianism. In his famous 1976 speech to the Labour Party Conference

he declared:

“We used to think that you could spend your way out of a recession, and increase employment by cutting taxes and boosting Government spending. I tell you in all candour that that option no longer exists, and that in so far as it ever did exist, it only worked on each occasion since the war by injecting a bigger dose of inflation into the economy, followed by a higher level of unemployment as the next step. Higher inflation followed by higher unemployment.”

Although the Labour Party as a whole did not accept Callaghan’s position, by then it was clear that the previous Butskellist consensus had been shattered. The Keynesian idea that government could stimulate an economy by deficit spending was no longer the conventional wisdom. The simplistic family-budget view of government finances returned. In the UK, both the Conservatives and the Labour Party played their part in this shift.

Austerity after the Great Crash of 2008

Fast-forward to the global economic crisis of 2008. Gordon Brown, who was Labour Prime Minister from 2007 to 2010, has rightly been given credit for his adept role in dealing with the potential collapse of the global financial system. There is nothing like a major war or a banking collapse to restore temporary faith in Keynesian stimuli.

But that did not mean that Labour had abandoned austerity. Alistair Darling was the Chancellor of the Exchequer under Brown and together they were responsible for fiscal packages that prevented financial collapse. But in his final budget of 24 March 2010, Darling announced public expenditure cuts in the order of 25 per cent over six years. He admitted that these cuts would be “deeper and tougher” than Thatcher’s in the 1980s.

A few weeks’ later, Labour lost the 2010 general election. The Conservatives and the Liberal Democrats formed a coalition government. Under the leadership of Nick Clegg, the Liberal Democrats turned, like the other two major parties, towards austerity. Clegg was not a Keynesian. In 2009 he had declared that “bold and even ‘savage’ cuts in government spending will be necessary to bring the public deficit down after the next election”. In coalition the Liberal Democrats were able to implement some progressive measures and to prevent a referendum on membership of the European Union. But this was against a background of severe economic austerity.

The Liberal Democrats paid a huge price for this collaboration. In the 2015 general election the Conservatives won an overall majority. The Liberal Democrats lost 49 of their 57 seats in Parliament. Clegg resigned as party leader. Prime Minister David Cameron called the referendum on EU membership in 2016. Austerity continued.

Did austerity work?

Between 2010 and 2019 more than £30 billion of spending reductions

were made to welfare payments, housing subsidies, school building programmes, police funding, and social services. Several previous studies have estimated that austerity led to well over 100,000 excess deaths. Some recent research pushes that figure much higher.

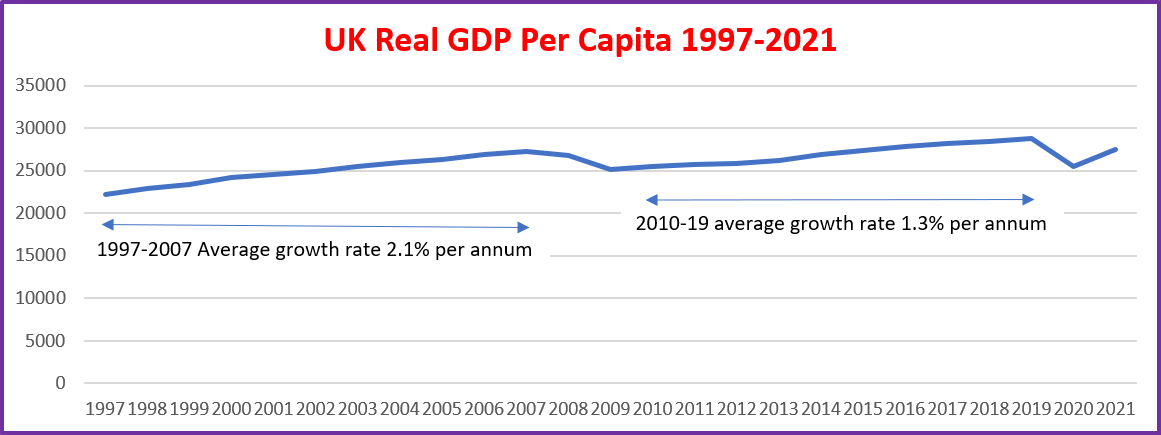

The 2007-9 decline in GDP per capita was due to the global financial crises and the 2019-21 decline is due to the Covid pandemic. The average annual growth rate of real GDP per capita from 1997 to 2007 (under a Labour Government) was 2.1 per cent, and from 2010 to 2019 (under Tory-led governments and austerity) it was 1.3 per cent.

Economic austerity did not lead to increases in growth. Growth was slower and remained so until the post pandemic upturn of 2020-21. From the 2007 pre-Crash peak to the 2019 pre-Covid peak, growth was only 0.5 per cent per annum. The UK economy since the 2008 Crash has been stagnant.

The little growth that happened has benefitted the rich much more than the poor. A damning 2022 report by the Resolution Foundation

made this point: “Poor households have experienced no income growth in the 15 years running up to the pandemic and the basic level of benefits is now only 13 per cent of average pay – the lowest level on record.” It reported the chronically low levels of productivity growth and the failures of successive governments to deal with the fundamental economic weaknesses in the UK. In 2021 the UK Office for Budget Responsibility forecast that 2008 levels of real wages will not be reached again until after 2026.

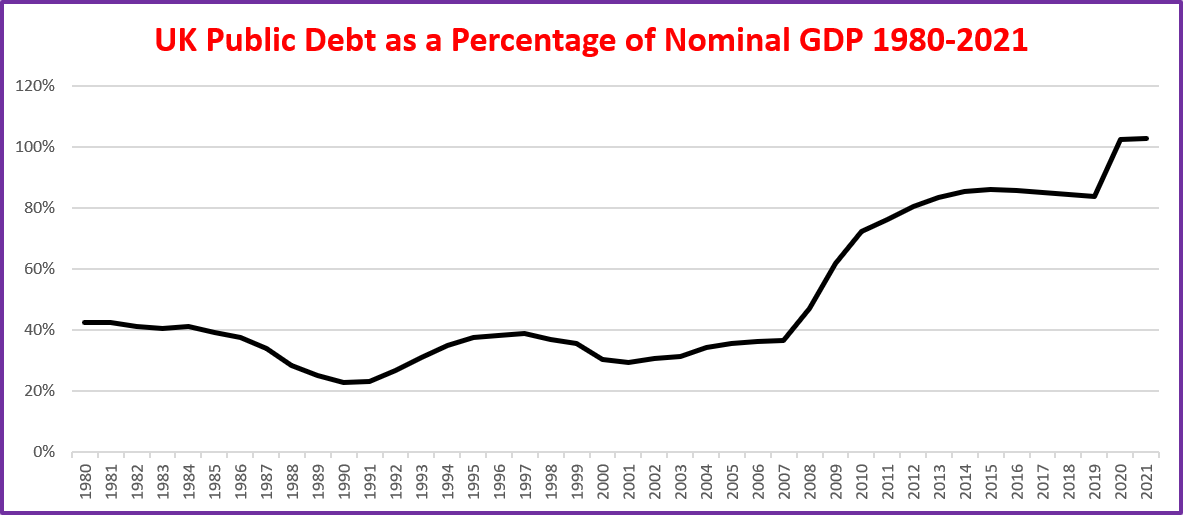

Overall, the Conservative government reduced this debt percentage by a small net amount from 1980 to 1997. Under Tony Blair, this debt was reduced slightly from 1997 to 2007. Arguably necessary efforts to deal with the subsequent financial crises meant a sharp increase in the debt from 37 per cent in 2007 to 72 per cent in 2010. Austerity failed to bring debt down to below this level. In 2019 it was 84 per cent of GDP. Since then it has risen further. Austerity failed on this score too. It did not reduce overall public debt.

Can a Keynesian stimulus rescue us now?

Arguments for Keynesian fiscal stimulation include ‘Modern Monetary Theory’ (MMT), developed by economists Steve Keen, Stephanie Kelton. Randall Wray and others. They argue that, for money-issuing governments, financial deficits are not a substantive problem. In principle, sovereign governments can issue money to expand their economies and pay for essential public services up to the point where labour and other resources are insufficient to provide any more of these required outputs. But then inflation could become a problem. At this point MMT advocates admit that a fiscal stimulus can be less effective.

These limits are more significant in the UK, which is a more open economy than the US. In the US in 2020 imports

and exports

were equivalent to respectively 13 and 10 per cent of its GDP. In the UK in 2020 imports

and exports

were both equivalent to 28 per cent of its GDP. The UK economy is much more dependent on imports and exports than the US. Furthermore, the US Dollar is the world’s leading reserve currency. The Pound Sterling is weaker.

All this means that any government in the UK has to be more careful about international financial markets and speculation against the pound, especially if inflation is rising or the balance of payments (exports minus imports) is too negative. These problems were dramatically illustrated by the falling Pound and the bond markets after the disastrous Kwarteng budget in September 2022.

MMT theorists are largely US-based. Many have paid too little attention to the problems in a more open economy such as the UK. Some even argue that foreign trade deficits are generally beneficial. I align with Steve Keen, who rejects this position. [2]

Despite the UK’s poor economic performance, its unemployment is relatively low by comparison with several other developed countries. There are chronic shortages of skilled labour in many sectors of the UK economy. Labour shortages and inflation are precisely the conditions that Keynesians and MMT theorists identify as placing limits on the use of public spending to stimulate the economy. Any excessive fiscal stimulus would risk adverse market speculation. A progressive government aiming at growth and economic recovery might fall in such a crisis. Austerity must be ended. But that does not mean enduring deficit-driven growth.

Hard Brexit – the elephant in the room

There is now a large amount of accumulating evidence that the UK decision to leave the European Union has had a hugely adverse impact on the country’s prospects for economic growth. But both the Conservative government and the Labour opposition have adopted a hard Brexit, by leaving both the EU Single Market and Customs Union, as well as ending EU membership. Other countries, such as Iceland and Norway, are not EU members but have full access to the EU Single Market. The Brexit referendum was simply about EU membership, not the EU Single Market or Customs Union.

Unspecified in the referendum, the hard Brexit option was a political choice by the two largest UK parties. It has dramatically reduced opportunities for exports and growth.

In 2022 the Office of Budget Responsibility reaffirmed that damage caused by Brexit would cost the UK 4 per cent of its GDP. This is equivalent to £100 billion in lost output, and £40 billion less revenue to the Treasury each year. This hard Brexit loss of public revenues is far in excess of currently planned austerity cuts.

Reversing hard Brexit, with or without the option of applying to re-join the EU, would be by far the easiest way of financing the public budget deficit, as well as dealing with copious problems of poverty, healthcare, education, skill training, public services, and infrastructure. It would help to put the UK back on track for recovery.

A first step would be for the UK to apply to re-join the EU Single Market. This would involve the re-introduction of freedom of movement with and within the EU. There is the further possibility of a customs union with the EU.

Some people are opposed to re-joining the EU Single Market because it would necessarily re-establish freedom of movement, which is one of its major features. In response, Britain has chronic shortages of skilled labour, which could be alleviated by migration from Europe. To help reverse the damage to the British economy, re-joining the EU Single Market is an urgent matter.

This suggests that both Conservative and Labour positions on the Single Market are deeply mistaken. In July 2022, the Labour Leader Keir Starmer stated that “with Labour, Britain will not go back into the EU. We will not be joining the single market. We will not be joining a customs union.”

The consequence of this acceptance of a hard Brexit is a 4 per cent reduction of GDP for every year of its perpetuation. By contrast, re-joining the EU Single Market would dramatically reduce much of this ongoing damage. Accepting a hard Brexit hit of £100 billion is severe austerity, albeit by different means. It means a dramatic deterioration in living standards for most of the British population.

The Liberal Democrats are partly responsible for damaging austerity in the 2010-15 period. But the indefinite austerity accepted by both Labour and the Tories as a result of an enduring hard Brexit is on a different scale and longevity altogether.

20 October 2022

1. Bank of England data from https://fred.stlouisfed.org/series/PSDOTUKA and https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicspending/bulletins/ukgovernmentdebtanddeficitforeurostatmaast/december2021.

2. Keen (2022, pp. 159-60).

References

Keen, Steve (2022) The New Economics: A Manifesto (Cambridge UK and Medford MA: Polity).

Kelton, Stephanie (2020) The Deficit Myth: Modern Monetary Theory and How to Build a Better Economy (London: Murray).

Keynes, John Maynard (1936) The General Theory of Employment, Interest and Money (London: Macmillan).

Wray, L. Randall (2012) Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems (London and New York: Palgrave Macmillan).